Fintech Galaxy was founded in the United Arab Emirates in 2018 as a regional platform that fuels innovation in financial services, drives ecosystem collaboration and facilitates integration between financial institutions and fintech companies. From scouting to deployment, Fintech Galaxy aim to build the future of financial services across the 22 Arab Countries.

Growing fast and furious

All FinTech industries make use of the latest technologies

during their financial journey. Companies involved in this

sector opt to provision a well-established platform that promote

greater security and higher resilience and bring greater

customer satisfaction while utilizing the principle of least

human efforts.

More FinTech companies have started to realize the power of

cloud computing and the massive value it can provide while

complying to international standards such as PCI DSS, ISO 27001

and ISO 20022. One of the main concerns these companies have

faced is the lack of skills and resources to maintain a robust

infrastructure in the cloud. Cloud computing thus allows an ease

of setup for highly available environments that require minimal

human intervention while focusing on business needs and

priorities instead of infrastructure.

Fortunately, Platform as a Service (PaaS) cloud computing helped

organizations like Fintech-Galaxy mitigate these concerns and

make it easier to orchestrate the deployment of various AWS

Services saving them considerable amount of time managing,

deploying, and debugging the underlying infrastructure.

Choosing the right provider

Fintech Galaxy noticed the power of PaaS for their business needs and decided to leverage this service with AWS being the first public cloud to provide PaaS since 2011. Moreover, Fintech Galaxy has chosen to run their Microsoft Workloads on AWS because of their superior platform, proven experience, and global reach in addition to a 2x better price performance for SQL servers and 7x fewer downtime hours than the next nearest cloud provider.

Why Us? Why Zero and One?

Fintech Galaxy had a tight deadline and wanted to publish their

Windows Workload within a weekend, so they approached Zero and

One a Premier AWS Partner specialized in automating Microsoft

deployments onto AWS and focusing on Cloud Migration, Security &

Compliance, and DevOps solutions. Zero and One dedicated a team

of certified experts to assess and understand the current state

of Fintech Galaxy platform to offer the solution that meets the

client’s needs.

Accordingly, Zero and One team have highlighted the

opportunities and challenges for building a highly resilient and

secure windows workload on top of

AWS Elastic Beanstalk

that would address all the client’s challenges from quick

deployments to simplicity and accessibility.

Seamlessly Deploy and Manage Windows Server Applications

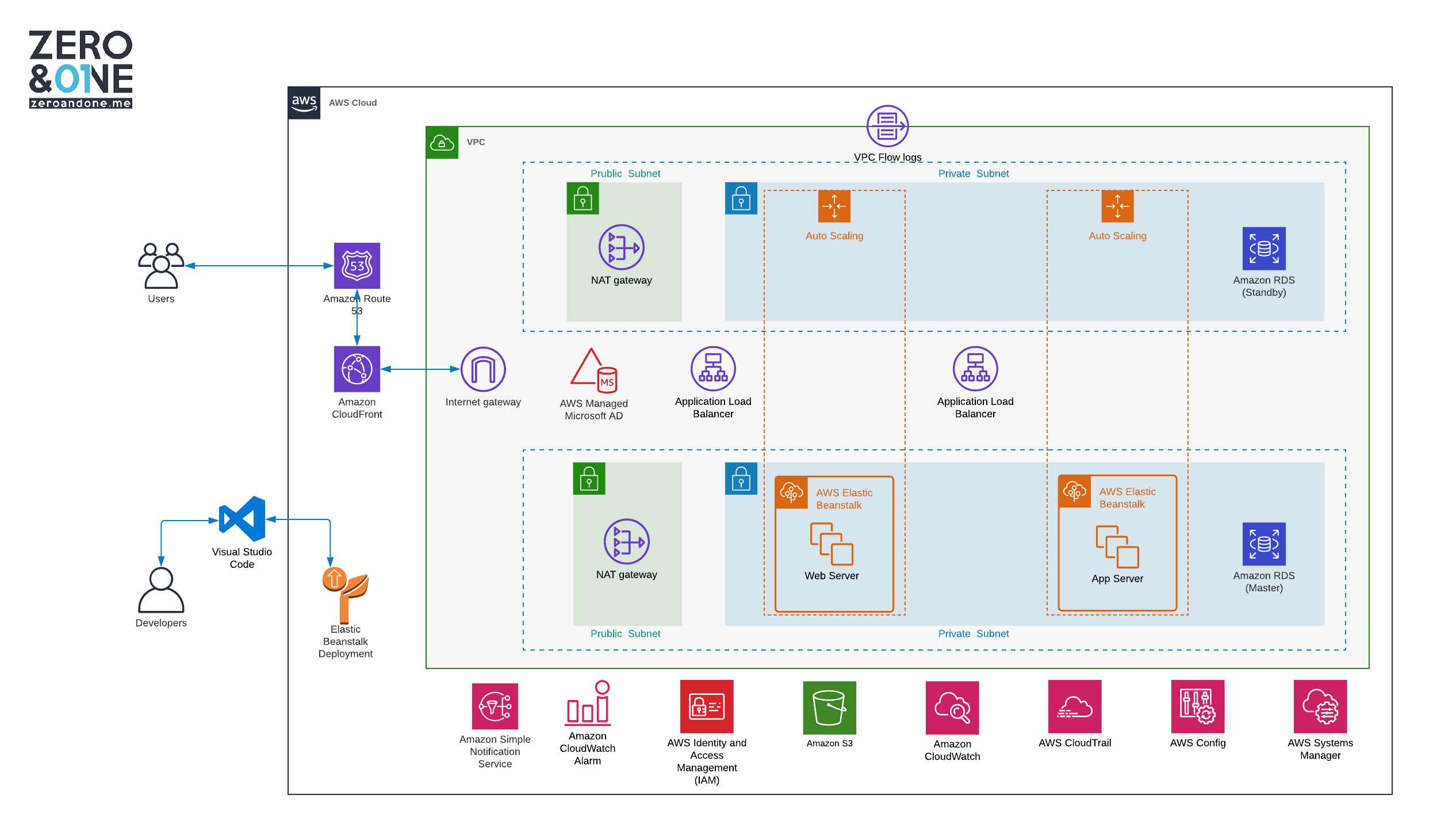

The design shown in the below diagram illustrates all the services required to provision a scalable 3-Tier .NET web application that can be fully setup in a timely manner. The core service used to deploy the .NET platform was AWS Elastic Beanstalk, an easy-to-use service for deploying and scaling web applications and services developed with .NET, PHP, Node. js, and more. Fintech Galaxy team was excited to witness the launch of this infrastructure with a couple of clicks. Elastic Beanstalk was used to provisions all the resources required for the Fintech Galaxy application that include two elastic load balancers, two autoscaling groups, and one Amazon EC2 instance for each of the Web and Application tier that can be scaled-out later depending on the needs.

The infrastructure was also configured in a private network that spans multiple availability zones (AZs) to maintain increased security and availability for the web and application tiers in addition to Amazon RDS for SQL Server instances with a multi-AZ deployment that provided more data durability, and fault tolerance.

In addition, AWS Managed Microsoft AD was setup for Fintech Galaxy’s windows-based authentication model for admins, users, and content that resides on IIS. This solution allows Fintech Galaxy to later extend their on-premises active directory to the AWS cloud and eliminate the maintenance complexity of a highly available Active Directory.

Developers were also able to deploy their code in minutes via

the

AWS Toolkit for Visual Studio

by following simple steps from their local machines and control

their deployments by providing quick rollbacks and easy disaster

recovery options from older versions that are kept and saved in

Elastic Beanstalk.

When simplicity brings efficiency

Ultimately, Zero and One Engineers helped increase customer productivity by ensuring the best use of Microsoft products in the cloud and ensured that the solution has met Fintech Galaxy’s critical business and technology objectives in a very short duration saving them more time than expected. Fintech Galaxy also realized a powerful performance and fast response time while running their windows workloads on AWS all given in a cost-effective monthly plan that guarantees an average return on investment (ROI) of 442% over the next five years.